The Bank of Canada is facing a difficult decision- as Canada's yield curve inverts even deeper, what will the Bank of Canada decide?

Posted by Billy Peshke on

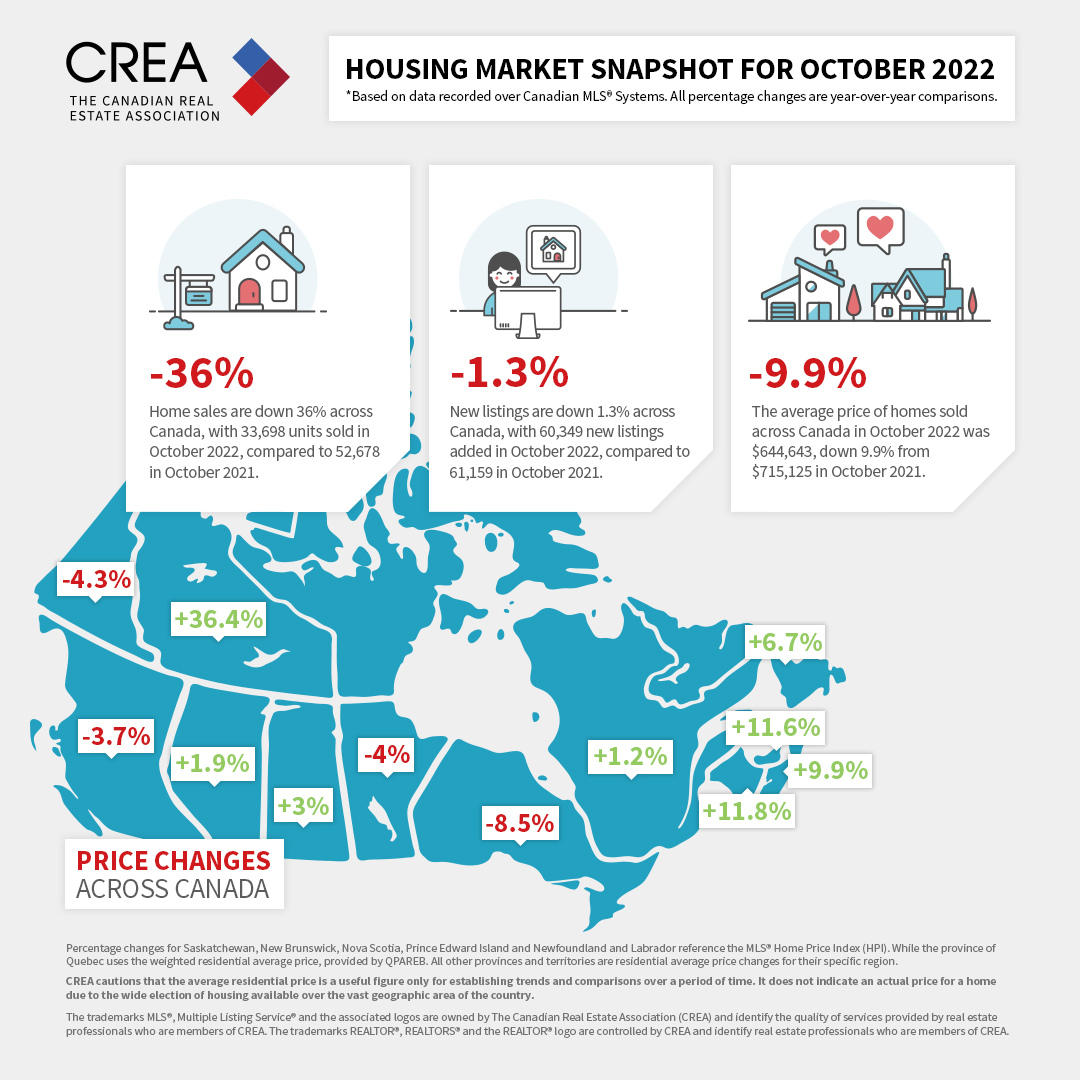

TORONTO (Reuters) - As the Bank of Canada considers ditching oversized interest rate hikes, it is dealing with an economy likely more overheated than previously thought but also the bond market’s clearest signal yet that recession and lower inflation lie ahead.

Canada’s central bank says that the economy needs to slow from overheated levels in order to ease inflation. If its tightening campaign overshoots to achieve that objective it could trigger a deeper downturn than expected.

The bond market could be flagging that risk. The yield on the Canadian 10-year government bond has fallen nearly 100 basis points below the 2-year yield, marking the biggest inversion of Canada’s yield curve in Refinitiv data going back to 1994 and deeper than the U.S.…

229 Views, 0 Comments